【摘 要】

中马两国自1974年建交以来,经贸合作持续深化。2023年,中马双边贸易额达1770亿美元,马来西亚连续14年保持中国在东盟最大贸易伙伴地位[1]。随着中资企业赴马投资规模扩大(2023年中国对马直接投资存量超80亿美元),税收成本与合规风险成为企业决策核心。中马税收协定(全称《中华人民共和国政府和马来西亚政府关于对所得避免双重征税和防止偷漏税的协定》)及马来西亚本土税收优惠政策,为企业提供了降低税负、规避双重征税的制度工具。本文从税收体系、协定条款、实操应用三方面展开分析,助力企业精准把握政策红利。

Abstract

Since the establishment of diplomatic relations in 1974, China and Malaysia have continuously deepened their economic and trade cooperation. In 2023, the bilateral trade volume between the two countries reached 177 billion US dollars, and Malaysia has remained China's largest trading partner in ASEAN for 14 consecutive years [1]. With the expansion of Chinese enterprises' investment in Malaysia (China's direct investment stock in Malaysia exceeded 8 billion US dollars in 2023), tax costs and compliance risks have become the core of business decisions. The China-Malaysia Tax Treaty (officially known as the "Agreement between the Government of the People's Republic of China and the Government of Malaysia for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income") and Malaysia's local tax incentives provide enterprises with institutional tools to reduce tax burdens and avoid double taxation. This article analyzes from three aspects: the tax system, treaty provisions, and practical application, to help enterprises accurately grasp policy benefits.

关键词:马来西亚 税收优惠

Key words: Malaysia, tax incentives

一、马来西亚税收体系与核心税种

一、Malaysia's Tax System and Core Tax Types

1.1 税收管理架构与征税原则

1.1Tax Administration Structure and Taxation Principles

马来西亚实行联邦与州分税制,联邦政府负责所得税、关税等主要税种,州政府征收土地税、矿产税等地方性税种。税收征管由联邦财政部统筹,内陆税务局(IRBM)负责直接税(如企业所得税),皇家关税局(Customs Department)负责间接税(如销售税、服务税)[2]。

马来西亚采用属地征税原则,即仅对来源于或产生于马来西亚的所得征税(海运、空运及特定金融机构除外),境外收入免征所得税,股东分红亦免税[3]。此原则与中资企业全球运营模式高度契合,是吸引投资的重要政策优势。

Malaysia implements a federal and state tax distribution system. The federal government is responsible for major taxes such as income tax and tariff, while the state government collects local taxes such as land tax and mineral tax. Tax collection and administration are coordinated by the Federal Ministry of Finance. The Inland Revenue Service (IRBM) is responsible for direct taxes (such as corporate income tax), and the Royal Customs Department is responsible for indirect taxes (such as sales tax and service tax) [2].

Malaysia adopts the principle of territorial taxation, meaning that only income derived from or generated in Malaysia is taxed (except for sea, air and specific financial institutions), and income from outside the country is exempt from income tax. Shareholder dividends are also tax-exempt [3]. This principle is highly consistent with the global operation model of Chinese-funded enterprises and is an important policy advantage for attracting investment.

1.2 主要税种与税率

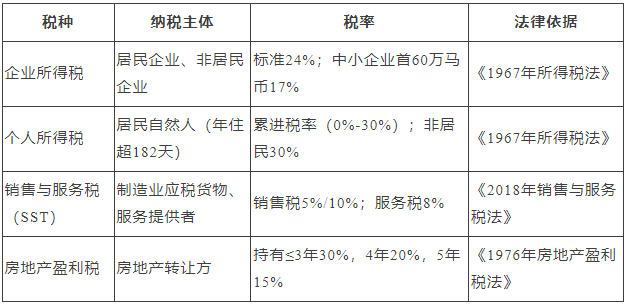

马来西亚税种结构简洁,核心税种包括企业所得税、个人所得税、销售与服务税(SST)等(见表1):

Malaysia has a simple tax structure, with core taxes including corporate income tax, personal income tax, sales and services tax (SST), etc. (See Table 1):

注:中小企业指实缴资本≤250万马币且年应税收入≤5000万马币的居民企业。

二、中马税收协定核心条款解析

二、Analysis of the Core Provisions of the China-Malaysia Tax Treaty

2.1 税务居民身份认定

2.1Tax resident status determination

税务居民身份是适用协定优惠的前提。根据中马协定第一条,仅对缔约国一方或双方居民适用协定优惠[4]。

马来西亚居民企业:董事会每年在马来西亚召开、董事在境内掌管公司业务的法人(材料1)。此类企业需就全球收入在马纳税,但可享受本土税收优惠(如新兴工业地位)。

中国居民企业:依法在中国境内成立或实际管理机构在中国的企业。其在马所得需按协定规则判定是否构成常设机构(PE),以确定纳税义务。

Tax resident status is a prerequisite for enjoying the benefits of the agreement. According to Article 1 of the China-Malaysia Agreement, the preferential treatment under the agreement is only applicable to the residents of one or both contracting states [4].

Malaysian resident enterprises: Legal persons whose boards of directors are held annually in Malaysia and whose directors manage the company's business within the country (Material 1). Such enterprises are required to pay taxes in Malaysia on their global income, but they can enjoy local tax benefits (such as emerging industry status).

Chinese resident enterprises: Enterprises that are lawfully established within the territory of China or whose actual management institutions are located in China. The income earned in Malaysia needs to be determined in accordance with the rules of the agreement to determine whether it constitutes a permanent establishment (PE) in order to ascertain the tax liability.

2.2 常设机构(PE)判定规则

2.2 Rules for Determining Permanent Establishment (PE)

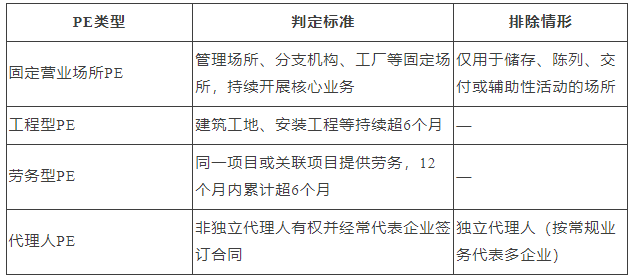

常设机构是来源国对非居民企业营业利润征税的关键依据。中马协定第五条明确PE的四类情形及排除规则(见表2):

The permanent establishment is the key basis for the source country to tax the operating profits of non-resident enterprises. Article 5 of the China-Malaysia Agreement clearly stipulates four types of scenarios for PE and the exclusion rules (see Table 2)

实务提示:中国母公司若在马长期派驻人员提供非辅助性服务、设立独立办事处或通过非独立代理人签约,可能被认定为PE,需就归属PE的利润在马纳税(《中华人民共和国企业所得税法实施条例(2024修订)》第五条)[5]。

Practical Tip: If a Chinese parent company has long-term personnel stationed in Malaysia to provide non-auxiliary services, sets up an independent office, or signs contracts through non-independent agents, it may be recognized as a private equity (PE) and is required to pay taxes in Malaysia on the profits attributable to the PE (Article 5 of the Implementing Regulations of the Enterprise Income Tax Law of the People's Republic of China (Revised in 2024)) [5].

2.3 预提税优惠机制

2.3 Withholding Tax Incentive Mechanism

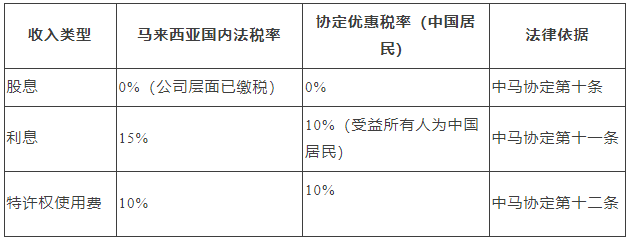

跨境支付(如股息、利息、特许权使用费)的预提税(WHT)是企业关注重点。中马协定对部分所得设定了低于马来西亚国内法的优惠税率(见表3):

The withholding tax (WHT) on cross-border payments (such as dividends, interest, and royalties) is a key focus for enterprises. The China-Malaysia Agreement sets preferential tax rates for some income that are lower than those under Malaysian domestic law (see Table 3) :

关键条件:利息优惠需满足“受益所有人”身份(对所得有控制权、处置权);若支付股息的股份与中国股东在马PE有实际联系,则不适用免税条款(中马协定第七条)。

Key condition: The interest discount must meet the status of "beneficial owner" (having control and disposal rights over the income). If the shares paying dividends have an actual connection with the PE of Chinese shareholders in Malaysia, the tax exemption clause does not apply (Article 7 of the China-Malaysia Agreement).

2.4 避免双重征税机制

2.4 Avoid double taxation mechanisms

中马协定通过“划分征税权”与“税收抵免”双重机制消除双重征税:

营业利润:仅由PE所在国(马来西亚)对归属PE的利润征税,中国作为居民国对企业全球利润征税时,允许抵免在马已缴税款(《中华人民共和国企业所得税法(2018修正)》第二十三条)[6]。

股息:中国居民企业从马子公司取得股息,若持股≥10%,可间接抵免马子公司就该股息利润已缴的企业所得税(中马协定第二十三条)。

实操案例:中国A公司持有马来西亚B公司30%股权,B公司2023年利润1000万马币(已缴马企业所得税240万马币)。A公司分得股息200万马币(税后利润),在中国申报时,可抵免B公司已缴税款中归属于该股息的部分(240万×200万/(1000万-240万)≈63.16万马币),降低中国税负。

The China-Malaysia Agreement eliminates double taxation through a dual mechanism of "division of taxation rights" and "tax credits".

Operating profit: Only the profit attributable to the PE is taxed in the country where the PE is located (Malaysia). When China, as a resident country, taxes the global profits of enterprises, it is allowed to offset the tax already paid in Malaysia (Article 23 of the Enterprise Income Tax Law of the People's Republic of China (Amended in 2018)) [6].

Dividends: If a Chinese resident enterprise receives dividends from its subsidiary in Malaysia and holds more than 10% of the shares, it can indirectly offset the enterprise income tax already paid by the subsidiary in Malaysia on the dividend profits (Article 23 of the China-Malaysia Agreement).

Practical case: Company A from China holds a 30% stake in Company B from Malaysia. Company B made a profit of 10 million Malaysian Ringgit in 2023 (having paid 2.4 million Malaysian Ringgit in corporate income tax). Company A received a dividend of 2 million Malaysian Ringgit (after-tax profit). When filing in China, it can be used to offset the portion of the tax paid by Company B that belongs to this dividend (2.4 million ×2 million/(10 million - 2.4 million) ≈ 631,600 Malaysian Ringgit), thereby reducing the tax burden in China.

三、税收优惠政策实操应用与合规风险

三、Practical Application of Tax Preferential Policies and Compliance Risks

3.1 本土税收优惠政策

3.1 Local tax preferential policies

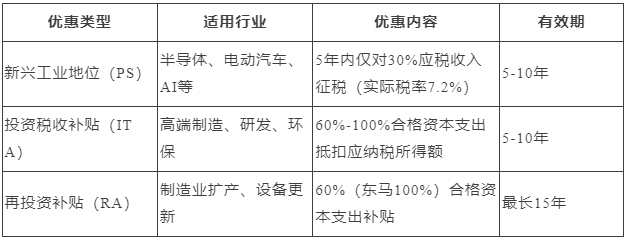

马来西亚为吸引外资,推出“新投资激励基金”(NIIF),覆盖新兴工业地位(PS)、投资税收补贴(ITA)等(见表4):

To attract foreign investment, Malaysia has launched the "New Investment Incentive Fund" (NIIF), covering emerging industrial status (PS), investment tax subsidies (ITA), etc. (See Table 4)

案例:中国新能源企业C在马设立电动汽车电池厂,申请PS资格后,首5年实际税率降至7.2%;若同步申请ITA,60%设备采购成本可抵扣应纳税所得额,综合税负显著降低。

Case: Chinese new energy enterprise C established an electric vehicle battery factory in Malaysia. After applying for PS qualification, the actual tax rate for the first five years was reduced to 7.2%. If an ITA application is made simultaneously, 60% of the equipment procurement cost can be deducted from the taxable income, significantly reducing the overall tax burden.

3.2 合规风险提示

3.2 Compliance Risk Warning

PE认定风险:母公司与子公司的服务往来、人员派遣需明确边界,避免因辅助性活动外的持续业务构成PE。

关联交易风险:跨境购销、融资需遵循独立交易原则(中马协定第九条),不合理定价可能引发税务调整。

优惠维持风险:PS/ITA企业需定期向MIDA提交进展报告,维持最低投资额与就业岗位,否则可能被取消优惠。

PE identification risk: The service transactions and personnel dispatch between the parent company and its subsidiaries need to have clear boundaries to avoid the formation of PE due to continuous business outside of auxiliary activities.

Risk of related-party transactions: Cross-border purchases and sales, as well as financing, must follow the principle of independent transactions (Article 9 of the China-Malaysia Agreement). Unreasonable pricing may lead to tax adjustments.

Risk of discount maintenance: PS/ITA enterprises need to submit progress reports to MIDA regularly, maintain the minimum investment amount and job positions, otherwise the discount may be cancelled.

结语

Conclusion

中马税收协定与马来西亚本土税收优惠政策,为中资企业提供了降低税负、规避双重征税的制度保障。企业需精准把握税务居民认定、PE判定、预提税优惠等核心规则,结合行业特性与投资阶段(如设立、扩产、分红)选择适用政策,同时关注ESG披露、清真认证等新兴合规要求。未来,随着中马“两国双园”等合作深化,税收政策将持续优化,为企业提供更广阔的发展空间。

The China-Malaysia tax treaty and Malaysia's local tax preferential policies provide institutional guarantees for Chinese-funded enterprises to reduce tax burdens and avoid double taxation. Enterprises need to accurately grasp core rules such as tax resident identification, PE determination, and withholding tax preferences, select applicable policies based on industry characteristics and investment stages (such as establishment, expansion, and dividend distribution), and at the same time pay attention to emerging compliance requirements such as ESG disclosure and halal certification. In the future, as cooperation between China and Malaysia such as the "Two Countries, Two Parks" initiative deepens, tax policies will continue to be optimized, providing enterprises with broader development space.

参考文献:

[1] 中国海关总署.2023年中马双边贸易统计报告[R].北京: 中国海关总署, 2024.

[2] 马来西亚财政部.马来西亚税收管理体系指南[Z].吉隆坡: 马来西亚财政部, 2023.

[3] 《中华人民共和国政府和马来西亚政府关于对所得避免双重征税和防止偷漏税的协定》[S].1985年11月23日签署.

[4] 《中华人民共和国企业所得税法(2018修正)》[S].2018年12月29日修订.

[5] 《中华人民共和国企业所得税法实施条例(2024修订)》[S].2025年1月20日修订.

作者简介

杨一平

北京市京师(郑州)律师事务所

党委政府法律顾问事务部

实习律师